|

Category: Consumer Services

Do you know the true power of credit and what it means for the future? Well, let’s talk about it.

Did you know that your financial health revolves around your credit and FICO score? Do you know your credit score? A poor credit score and a bad credit history are costly! Your credit can impact many things from interest rates to high insurance premiums. Without a strong credit score, you could be denied the ability to rent, purchase a car, get credit cards and obtain a mortgage. Your credit can even be used when being considered for employment! Can you believe that? How dare them…. Know that the cost of bad credit and a low credit score can cost you hundreds and thousands of dollars over the course of your lifetime. Having bad credit can cause a person to make higher deposits on something as just getting a cell phone? Poor credit will have you paying deposits on utility bills, cable, and again as mentioned paying much higher interest on purchases So, let’s just think about this for a moment… If you need a co-signer, then it’s time to seriously start fixing YOUR credit

Let’s briefly analyze these things and their importance.

I’m sure you are aware that our beloved Prince had NO Will or Trust and his estate is tied up in probate as we speak. And now our beloved Aretha Franklin had no Will or Trust either. And her estate could very well get tied up in probate if the family is unable to make and agree on how to distribute her money, personal treasures, music, etc...

All of these things are important and if you haven’t put something in place, you need to get moving. An illness or an accident can change your entire world for you and your loved ones. Now let’s assume you’ve taken the step to restore your credit and things have greatly improved. But the thing about restoring your credit also means you need to understand and become financially educated. It would be a shame to get all this done and create a disastrous situation all over again. The last thing I want to bring up is to ask yourself - are you on track to be able to reach financial freedom at this point in your life? In other words, getting to a Debt – Zero status… It is possible but, you need a system and a budget to get you there and again this is how and where financial education is vital to all of this and what I have talked about. And you know what? If you’re finally tired of being DENIED every time you try to get a new car, credit card(s) or being able to buy a home for you or your family, then guess what? I can help you get ALL of this handled and more… Don’t delay this any longer, remember credit is “Power” let’s get your Power back! And we can get started doing that today!

Related Posts:

How to Locate A Life Insurance Policy: Free Life Insurance Locator Tool how-to-locate-a-life-insurance-policy-free-life-insurance-policy-locator.html Social Security and Veterans Survivor's Benefits www.canmichigan.com/death-and-burial.html

6 Comments

Category: Government Benefits and Programs

Program Goals and Objectives

Disability benefits are designed to provide a basic income as a preventative measure for escaping abject poverty when a person becomes severely injured, psychologically impaired, or ill due to a serious medical condition. But, it is deficient in providing recipients with a lifestyle of independence and self-sufficiency. The goals of the Ticket-to-Work program are to:

The objectives of Ticket-to-Work and PASS are to help disabled individuals find employment that reduces or eliminates SSI or SSDI benefits. Ticket-to-Work The Ticket-to-Work program does not require a special application process. Disabled beneficiaries who receive cash benefits from Social Security are entitled to participate in the program and may enroll with an approved service provider of their choice. Beneficiaries may enroll with an Employment Network (EN) or State Vocational Rehabilitation (VR) agency. The EN or State VR will coordinate and provide appropriate services to help the beneficiary find or maintain employment. Free job support services include:

Ongoing support services also involves the initiative to remove barriers from achieving work goals. This can include purchasing clothing, equipment, or a vehicle when necessary for employment; or, making repairs to an existing vehicle, help with driver license restoration and purchasing car insurance. Please inquire with your chosen service provider for details on criteria and eligibility requirements for these services. Social Security will not send a paper ticket in the mail. Recipients of Social Security Disability Insurance (SSDI) or Social Supplemental Income (SSI) benefits, age 18 to 64, are eligible to participate. Eligibility is verified through service providers and you can verify your eligibility status by calling the Ticket-to-Work Helpline. Ticket-to-Work Helpline: PH: (866) 968-7842 TTY: (866) 833-2967 How to Apply for Ticket-to-Work

The worksheet will provide a list of questions you may want to ask and a space to write your answers which may help with the decision to assign your ticket. Beneficiaries may choose between an Employment Network (EN) or State Vocational Rehabilitation (VR) agency for ticket assignment based on your needs and the services provided. Beneficiaries may also receive services from a State Vocational Rehabilitation (VR) agency and then receive ongoing services from an Employment Network (EN). Work Incentives Work Incentives not only encourage beneficiaries to reduce or eliminate their reliance on social security it also helps in transitioning from benefit rolls to the workforce.

Beneficiaries who opt to participate in the Ticket-to-Work program are afforded the opportunity to safely explore work options and find the job that is right for them without immediately losing their benefits. If employment earnings surpass allowable benefit amounts, your disability case will remain open up to one (1) year should your disability impair your ability to continue to work and there is a need to return or restore social security benefits. You do not need to reapply or start a disability case over from the beginning. Social Security will not terminate your case for up to one (1) year after the start of employment. Cases where employment earnings exceed benefit amounts are held open in a "non-pay" status in case the beneficiary cannot sustain employment due to their health. After the one (1) year non-pay status period, beneficiaries must reapply. Work Incentives are designed to meet individual needs and circumstances. For a complete guide to Social Security Work Incentives consult the SSA Red Book. Beneficiaries can use a combination of Work Incentives to maximize their income until they can secure stable employment and adequate income to support themselves. Examples of Work Incentives:

These are a few examples of work incentives for recipients of Social Security disability benefits and the program is even more generous for those who are blind. Click the link for more information on Work Incentives for Blind People: Beneficiaries may register for a Work Incentive Seminar Event (WISE), a monthly online webinar provided by the Social Security Administration (SSA). The WISE webinar helps SSDI and SSI beneficiaries learn more about Ticket-to-Work and Work Incentives. WISE Webinar Registration: PH: (866) 968-7842 TTY: (866) 833-2967 Use the link to register online for a webinar: https://choosework.ssa.gov/webinar/ Continuing Disability Reviews (CDRs) Social Security recipients are periodically subject to Continuing Disability Reviews (CDRs) every three (3), five (5), or seven (7) years to determine if a recipient still meets SSA guidelines for disability. However, when a beneficiary chooses to participate in the Ticket-to-Work program they are protected from the medical Continuing Disability Review (CDR). The income and asset test will be an ongoing process through wage reporting or the Work Disability Review (WDR) process. In either process, work earnings are monitored which will be incrementally deducted until cash benefits are zeroed out. For more information about medical or work disability reviews, contact the Social Security Administration at: (800) 772-1213. Beneficiaries should also be aware that when enrolled in the Ticket-to-Work program they are expected to take certain steps toward preparing for a job, finding work, or maintaining current employment within a specified time frame. Time frames are determined by Social Security to maintain wages within a certain level and complete job training or educational program. The steps taken to meet employment goals are outlined in the work plan developed between the beneficiary and chosen Employment Network (EN). Employment Networks (EN) and State Vocational Rehabilitation (VR) Agencies An Employment Network (EN) is a private organization or public agency (including a State VR agency) which entered into an agreement to provide employment services, vocational rehabilitation services, and other types of support to beneficiaries with disabilities under the Ticket-to-Work program. Beneficiaries can contact any EN to see if the services and support offered are right for them. There are different types of service providers and each type of service provider provides different services. It is important to understand the services each provider offers before searching so you can select the best provider to suit your needs. Types of Service Providers:

Types of Services:

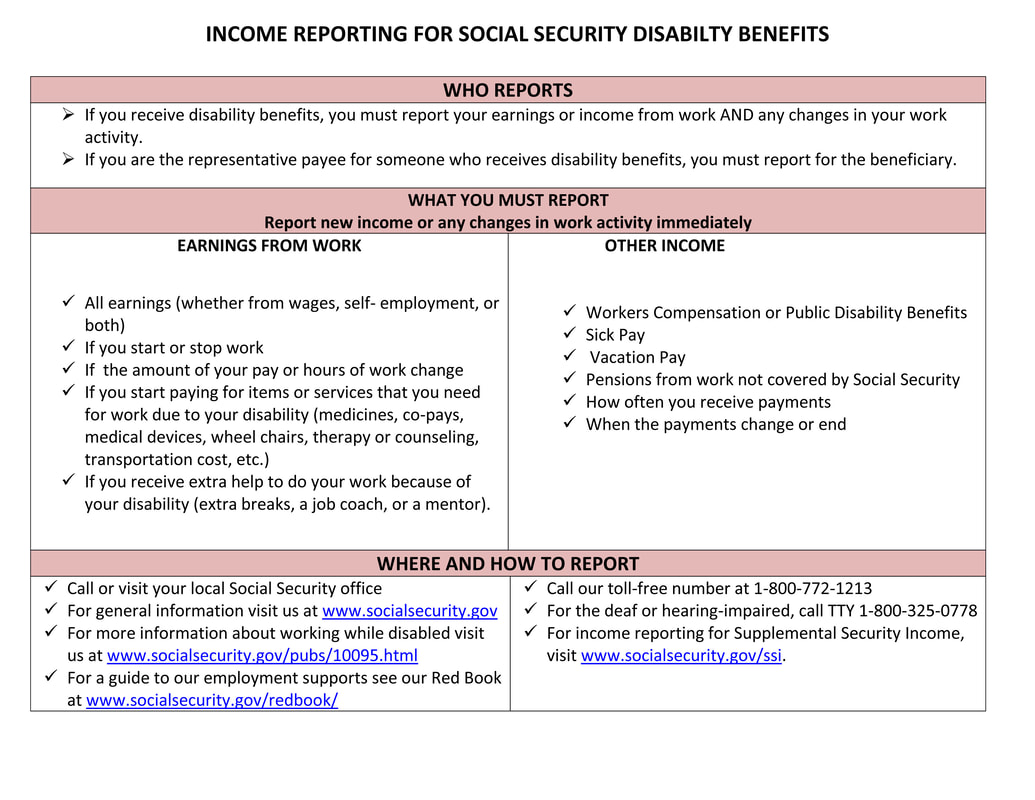

State Vocational Rehabilitation (VR) Agencies assists individuals who desire to return to work or obtain new employment but require more significant services for work to be possible. State VRs help beneficiaries get ready for work then refer them to an Employment Network (EN) to help them keep the job and make more money. Likewise, beneficiaries receiving services from State VRs are assumed to be using a Ticket and, therefore, exempt from Continuing Disability Reviews (CDRs). Work Plans The beneficiary and EN must agree and develop a work plan that describes the beneficiary’s employment goal. The plan serves as a roadmap that helps the beneficiary understand their responsibilities and outlines the services and support the EN will provide to help the beneficiary reach their goal. Use the Planning Your Employment Goals with the Ticket-to Work Program tool to help you define your employment goals and needs from the program. The Your Path to Work tool helps you identify your phase in making the decision to return to work, look for a job, or maintain current employment. Beneficiaries may talk to as many ENs as they wish before choosing to assign their Ticket. If a beneficiary assigns his or her Ticket to an EN and later has a change of mind about working with that EN, the beneficiary can un-assign the ticket and take it to another EN. Wage Reporting Beneficiaries who participate in the Ticket-to-Work program are required to report earned income monthly once new employment has begun. Social Security allows no more than six (6) days after the end of each month for wage reporting. Recipients may submit pay stubs by certified mail or in-person at a local Social Security office. Wages may also be reported by a representative payee, spouse, parent, or sponsor of the SSDI/SSI recipient via telephone, mobile app, or the mySocialSecurity website. PH: (800) 772-1213 TTY: (800) 325-0778 Use the Social Security Office Locator tool to find an office near you: Use the Income Reporting Chart for Social Security Benefits on wage reporting requirements.

A link is provided below for more information on wage reporting.

How to Calculate Benefit Deductions Beneficiaries who decide to participate in the Ticket-to-Work program will either reduce or eliminate their reliance on disability benefits. While the first $85 of earnings are not counted, beneficiaries whose income rises above benefit levels will "zero out" their disability payment and lose eligibility for Medicaid health insurance. The formula to estimate your deductions where N = net earnings and D = deductions is:

That is, the first $85 of earnings are deducted from the Net Income (N). The balance of the Net Income (N) is then divided by 2 and the balance or difference becomes the Deducted Amount (D) from the Social Security payment.

Example of a Benefit Deduction:

Beneficiaries are required to report earnings after the first thirty (30) days of employment. Benefits are affected after the second thirty (30) days. Example of Wage Reporting:

That means, the beneficiary can retain their Social Security payments for the first sixty (60) days of employment without penalty as long as the income is reported. Again, if earnings exceed benefit amounts and the Social Security payment is "zeroed out" the case remains open for one (1) year in a "non-pay status."

Plan to Achieve Self-Support (PASS)

PASS is yet another provision to help disabled persons who receive or qualify for Supplemental Security Income (SSI) benefits return to work. PASS allows disabled individuals set aside monies or assets that would otherwise be counted as income toward benefit amounts to pay for items or services needed to achieve a work goal. A PASS can include supplies to:

PASS can help the participant save money to pay these costs, make purchases, installment payments, or downpayments on a vehicle, computer, or wheelchair to achieve a work goal. Beneficiaries interested in participating with the PASS program can contact an Employment Network, State Vocational Rehabilitation (VR) agency, or local Social Security office to apply. Applicants must complete the SSA-545-BK form to participate. Beneficiaries with a work goal of self-employment must also submit a business plan. PASS is also an option for claimants who otherwise medically qualify for SSI but whose income and assets exceed the maximum limitations ($2,000 for individuals, $3,000 for couples). This program will help those applicants financially qualify for SSI by setting-aside monies and property to reduce those assets. A link is provided below for more information. Was this post helpful? Leave a comment and please share with your followers. If you’re in need of case management services or need additional assistance complete the confidential Contact Form. Also, consider donating to continue this important work and expand our reach to the broader community. Contact Us: http://www.canmichigan.com/reach-out-to-us.html Donate: https://www.paypal.com/donate/?token=u9ZbQw7yTRWAm9K4Yl2MKERd76oKf_lBrejXuVLAx0j5rsSTG72gmICfR9S-bVY4az_Imm&country.x=US&locale.x=US Related Posts: Disability Resources http://www.canmichigan.com/disability-resources-michigan.html State Disability Assistance (SDA) Program Structure, Benefits, and Eligibility http://www.canmichigan.com/blog/michigan-state-disability-assistance-sda-program-structure-benefits-and-eligibility Case Management Services http://www.canmichigan.com/case-management-services.html Links: Social Security Ticket to Work Overview https://www.ssa.gov/work/overview.html Find A Ticket-to-Work Service Provider https://choosework.ssa.gov/findhelp/ Finding an Employment Network (EN) and Assigning Your Ticket Worksheet https://choosework.ssa.gov/library/finding-EN-assigning-your-ticket-worksheet Protection from Medical Continuing Disability Reviews (Social Security Administration) https://www.ssa.gov/disabilityresearch/wi/cdrprotection.htm Social Security Administration Work Site https://www.ssa.gov/work/ Comprehensive Guide to Service Providers and Services https://choosework.ssa.gov/about/meet-your-employment-team/index.html Social Security Red Book https://www.ssa.gov/redbook/ How to Report Wages https://choosework.ssa.gov/about/wage-reporting/index.html PASS – Social Security Overview https://www.ssa.gov/disabilityresearch/wi/pass.htm Guide to Plans for Achieving Self-Support https://www.ssa.gov/pubs/EN-05-11017.pdf Spotlight on Plan to Achieve Self-Support – 2018 Edition https://www.ssa.gov/ssi/spotlights/spot-plans-self-support.htm The Fully Accessible Guide To Starting A Business With A Disability www.creditcards.com/credit-card-news/accessible-guide-for-disabled-entrepreneurs.php Michigan Rehabilitation Services (MRS) PH: (800)605-6722 TTY: 7-1-1 Ticket-to-Work (MDHHS) www.michigan.gov/mdhhs/0,5885,7-339-73971_25392_40237_42063---,00.html SSA Timely Progress Guideline (MRS Ticket-to-Work Program) www.michigan.gov/documents/mdhhs/78b6epub-343_--_MRS_and_Ticket_to_Work_Program_--_2015_509997_7.pdf

Category: Public Policy

The Local Government Labor Regulatory Limitation Act (Public Act 84) prohibits local governments, that is, cities and counties located within the Michigan territory to adopt Ban-the-Box laws that will regulate the screening procedures of public and private employers. The original law (Public Act 104 of 2015) emphatically states that “matters of the employment relationship is a concern of the state”, in effect, stripping the authority of local governments to adopt an ordinance, local policy, or resolution that would infringe “don’t ask” regulations not expressly impermissable by law on employers. EMPLOYMEE RIGHTS AND ANTI-DISCRIMINATION LAWS There are literally a laundry list of rules regulating the hiring practices of employers in this country on the national and local levels, namely, the U.S. Civil Rights Act of 1964 and Americans With Disabilities Act (ADA). These are the two most comprehensive statutory regulations enacted by the federal government preventing discrimination in hiring as well as protections from in-work injustices such as harassment and retaliation. In Michigan, the Elliot-Larson Civil Rights Act and Persons with Disabilities Civil Rights Act protects applicants and existing employees against an even more expansive range of discriminatory hiring and employment practices. Furthermore, the Michigan Department of Civil Rights, anti-discrimination laws in employment and housing, publishes a Pre-Employment Inquiry Guide for employers. While the guide is intended to help employers maintain legal hiring and interviewing practices, it is also a handy tool that all job-seekers should familiarize themselves with. U.S. and Michigan laws regulating hiring and employment practices:

MICHIGAN EMPLOYMENT SCREENING REGULATIONS OVERVIEW The broad language of Michigan employment laws covers several areas of importance in preventing discriminatory hiring practices, including:

Recruitment Employers are encouraged to include statements promoting or affirming their commitment to equal employment opportunity practices. However, they are prohibited from publishing or circulating advertisements that indicate candidate preferences, specifications or limitations based on race, religion, color, national origin, age, sex, height, weight, marital status, and disability. Pre-Employment Inquiries Employers and employment agencies are prohibited except as permitted by law to ask questions (verbal or written) to elicit information, attempt to elicit information, or express a candidate preference based on race, religion, color, national origin, age, sex, height, weight, marital status, and disability of a prospective employee. This is intended to prevent characteristics which are not job-related from influencing the selection process. Example of an illegal inquiry: “How old are you?” “No, thank you, we are looking for someone younger.” Job Description Employers are required by law to write descriptions outlining the required skills and abilities for each job position enabling employers to select the most qualified candidates. Questions that elicit information that are unlawful during the pre-employment screening process may become legal once the extension of a job offer or hiring process begins. Such information is needed for payroll and benefit processing but should not be included on job applications or asked during an interview. Arrest Records Michigan law prohibits employers from inquiring about misdemeanor arrests that did not result in a conviction but are permitted to ask questions about the following:

Some employers are required by law to conduct a criminal background checks on potential hires. However, in most circumstances, employers may not refuse to hire or accept job applications from any and every person with criminal convictions. This is prohibited under Title VII of the U.S. Civil Rights Act of 1964. Data Collection Employers are limited to gathering information as permitted or required by law for certain occupations, restricting access to that information, and collecting data otherwise prohibited by law after a conditional offer of employment has been extended to a prospective candidate. Bona Fide Occupational Qualification It should be noted that employers can request to be exempt from laws that prohibit hiring practices based on characteristics such as religion, national origin, age, height, weight, or sex if it is a bona fide occupational qualification (BFOQ). That is, these characteristics are necessary for normal business operations. The BFOQ must be requested prior to posting a job position but can be used as a legal defense against discrimination charges even if the BFOQ was never obtained. A link to the Pre-Employment Inquiry Guide is provided below for more information. EEO/Workforce Diversity Plans The aggregate collection of data on race, religion, color, national origin, sex, or disability of applicants and employees as permissible by the requirement of Equal Employment Opportunity (EEO) and workforce diversity plans. The information gathered must be separate from the hiring or promotional processes. PRE-EMPLOYMENT INQUIRY GUIDELINES Source: Michigan Department of Civil Rights

Applicant’s current or prior addresses. Unlawful Pre-Employment Inquiry: N/A 2. Age Lawful Pre-Employment Inquiry: Are you 18 years or older? Unlawful Pre-Employment Inquiry: Applicant’s age or date of birth. 3. Arrests Lawful Pre-Employment Inquiry: Have you ever been convicted of a crime? or, Have you been arrested for a felony? Unlawful Pre-Employment Inquiry: Misdemeanor arrests that did not result in a conviction unless applicant is seeking a position with a law enforcement agency. (Only unlawful in Michigan, not covered by federal law). 4. Birthplace Lawful Pre-Employment Inquiry: N/A Unlawful Pre-Employment Inquiry: Birthplace of applicant’s and applicant’s relatives; birth certificate, naturalization and baptismal records, unless required by federal law. (Documents required by the Immigration and Reform Control Act (IRCA) may only be collected after a conditional offer of employment has been made). 5. Citizenship Lawful Pre-Employment Inquiry: Are you legally authorized to work in the United States? Unlawful Pre-Employment Inquiry: These questions are unlawful unless asked as part of the Federal I-9 process.

6. Disability Lawful Pre-Employment Inquiry: Ability to perform the essential functions of the job with or without accommodation. (Only lawful if applicant has been informed of essential job duties). Unlawful Pre-Employment Inquiry: Physical or mental conditions which are not directly related to the requirements of a specific job. 7. Education Lawful Pre-employment Inquiry: Applicant’s academic, vocational, or professional education and schools attended. Unlawful Pre-employment Inquiry: N/A 8. Genetic Testing Lawful Pre-employment Inquiry: N/A Unlawful Pre-employment Inquiry: Applicant’s genetic information or requiring an applicant to undergo genetic testing is unlawful. (Unlawful in Michigan, not covered by federal law). 9. Height or Weight Lawful Pre-employment Inquiry: N/A Unlawful Pre-employment Inquiry: It is illegal to inquire (verbal or written) about an applicant’s height or weight. (Unlawful in Michigan, not covered by federal law). 10. Marital Status Lawful Pre-employment Inquiry: N/A Unlawful Pre-employment Inquiry: Marital status or children: asking applicants to specify titles such as Mr., Mrs. Or Ms. (Unlawful in Michigan, not covered by federal law). 11. Name Lawful Pre-employment Inquiry: Applicant’s name or other names used. Unlawful Pre-employment Inquiry: Applicant’s maiden name. (Unlawful in Michigan, not covered by federal law). 12. National Origin Lawful Pre-employment Inquiry: Languages spoken or written by applicant. Unlawful Pre-employment Inquiry: Applicant’s lineage, ancestry, national origin, or nationality. 13. Notice in Case of an Emergency Lawful Pre-employment Inquiry: Name, address, and phone number of a person to be notified in case of an accident or emergency. Unlawful Pre-employment Inquiry: Name, address, and phone number of a relative to be notified in case of an accident or emergency. 14. Organizations Lawful Pre-employment Inquiry: The organizations and clubs to which applicants belongs with noted exceptions. Unlawful Pre-employment Inquiry: Names of organizations to which applicants belongs if information will reveal the race, color, religion, national origin, or ancestry of the members of the organization. 15. Photograph Lawful Pre-employment Inquiry: N/A Unlawful Pre-employment Inquiry: Applicant’s photograph prior to hire. 16. Race or Color Lawful Pre-employment Inquiry: N/A Unlawful Pre-employment Inquiry: Applicant’s race, national origin, or color. 17. Religion Lawful Pre-employment Inquiry: N/A Unlawful Pre-employment Inquiry: Religious denomination or affiliation; religious holiday’s observed. 18. Sex Lawful Pre-employment Inquiry: N/A Unlawful Pre-employment Inquiry: Applicant’s gender; ability or desire to have children; child care arrangements.

COMMONLY ASKED QUESTIONS ON EMPLOYEE RIGHTS

Can an employer do a background check to verify your GPA? Employers may request a copy of your college transcripts to verify your GPA. It is permissible by law and may help in the selection process between candidates. Can an employer ask if you are pregnant? Inquiring about an applicant’s or employee’s pregnancy status as a condition of employment or a promotion is prohibited. It is a violation of labor law and can result in legal liability against an employer. Can an employer ask if you smoke? While some states permit employers to inquire whether you are a smoker as a condition of employment Michigan law does not expressly regulate the practice. It also does not require employers to accommodate smokers or non-smokers with designated areas and are generally free to adopt smoking policies at their own discretion. However, issues of retaliation and harassment are directly prohibited by law. Employees who experience or suspect adverse sanctions for smoking in the workplace should contact the Michigan Department of Civil Rights or consult a legal representative. Can an employer run a credit check? In Michigan, employers can pull your credit report, but your permission is required. Not only does the law require your permission for an employer to request your records from credit bureaus, employers must also inform you of your rights under the Fair Credit Reporting Act (FCRA). Additionally, if you are denied employment due to your credit history, the employer must provide you a copy of your credit report and notice of adverse action. This provides the applicant an opportunity to respond. Was this post helpful? Leave a comment and please share with your followers. If you’re in need of case management services or need additional assistance complete the confidential Contact Form. Also, consider donating to continue this important work and expand our reach to the broader community. Contact Us: http://www.canmichigan.com/reach-out-to-us.html Donate: https://www.paypal.com/donate/?token=u9ZbQw7yTRWAm9K4Yl2MKERd76oKf_lBrejXuVLAx0j5rsSTG72gmICfR9S-bVY4az_Imm&country.x=US&locale.x=US Related Posts: Michigan Bans-the-Box for Felons http://www.canmichigan.com/blog/michigan-bans-the-box-for-felons Ban-the-Box Laws: Employment Rights for Felons http://www.canmichigan.com/blog/ban-the-box-laws-employment-rights-for-felons State Assistance Programs Enforce Work Requirements for Government Benefits http://www.canmichigan.com/blog/state-assistance-programs-enforce-work-requirements-for-government-benefits Links: Michigan Bans the Ban: New Law Stops Local Government Regulations on Employer Inquiries https://ogletree.com/shared-content/content/blog/2018/march/michigan-bans-the-ban-new-law-stops-local-government-regulations-on-employer-inquiries Michigan Department of Civil Rights: Pre-Employment Inquiry Guide https://www.michigan.gov/documents/mdcr/Preemploymentguide62012_388403_7.pdf What You Should and Shouldn’t Ask Job Candidates (For Employers) https://www.businessknowhow.com/manage/quick.htm Were You Denied A Job or Promotion Because of Your Credit Report? https://www.micreditlawyer.com/employment-and-credit-reports/ Resources: U.S. Department of Labor – Michigan Occupational Safety and Health Administration 315 West Allegan Street, Suite 207 Lansing, Michigan 48933 PH: (517) 487-4996 Fax: (517) 487-4997 Equal Employment Opportunity Commission (EEOC) Detroit District Office 477 Michigan Avenue Room 865 Detroit, MI 48226 PH: (800) 669-4000 TTY: (800) 669-6820 Fax: (313) 226-4610 Michigan Occupational Safety & Health Administration (MIOSHA) 530 W. Allegan Street P.O. Box 30643 Lansing, Michigan 48909-8143 Phone: (517) 284-7777 Fax: (517) 284-7725 Toll-Free Complaint Hotline: (800) TO-MIOSH ((800) 866-4674) Michigan Department of Licensing and Regulatory Affairs (LARA) Wage and Hour Division 2407 N. Grand River Avenue Lansing, MI 48906 PH: (855) 464-9243 (Toll Free) PH: (517) 284-7800 Fax: (517) 322-6352 Michigan Department of Civil Rights (MDCR) PH: (800)482-3604 (Toll Free) TTY: (877)878-8464 Website: www.michigan.gov/mdcr Michigan Department of Civil Rights Detroit Service Center - Cadillac Place 3054 W. Grand Boulevard Suite 3-600 Detroit, MI 48202 PH: (313)456-3700 Fax: (313)456-3701 Fax: (313)456-3791 (Executive Office) Divisions:

Michigan Department of Civil Rights Lansing – Capitol Tower Building 110 W. Michigan Avenue Suite 800 Lansing, MI 48933 PH: (517)335-3165 TTY: (517)241-1965 Fax: (517)241-0546 Website: MDCR-INFO@michigan.gov Michigan Department of Civil Rights Grand Rapids Office State Office Building, 4th Floor 350 Ottawa N.W. Grand Rapids, MI 49503 PH: (616)356-0380 TTY: (616)356-0391 Fax: (616)356-0399 Michigan Alliance Against Hate Crimes (MIAAHC) PH: (517)335-3165 Website: mdcrcrt@miaahc.com Category: Public Policy There has been a slight change in Michigan’s ban on “Ban-the-Box” ordinances. And a slight change it is. On Friday, September 7, 2018, the term-limited Governor Rick Snyder, signed an executive-directive ordering all Michigan departments to remove questions about criminal histories from state job applications effective October 1, 2018. More specifically, applications will no longer ask questions about prior felony convictions. Furthermore, the governor has also asked the Office of Licensing and Regulatory Affairs (LARA) to remove criminal background questions from licensing applications for skilled-trade workers except where required by federal or state law. That is, some professional licensing depending on the industry may or may not require a criminal background screening. The good news for returning citizens is that this will prevent state departments from utilizing criminal histories as an initial screening for employment. On the other hand, applicants seeking employment with the state will only be temporarily relieved of criminal background checks as they may be required to authorize it if offered employment after the initial application. The bad news is that this new change of heart for the governor did not cause him to reverse the law in Michigan which bans “Ban-the-Box” ordinances in our state. Neither did he apply his generosity to the private sector. He only states the hope that the initiative will work and other public and private employers will follow suit. Remember, this comes after he signed the “Local Government Labor Regulatory Limitation Act” into law on March 26, 2018. The law states that cities and counties located in the State of Michigan are, in fact, prohibited from adopting "ban-the-box" ordinances for felony convictions. So, we’ll see how this pans out. Was this post helpful? Leave a comment and please share with your followers. If you’re in need of case management services or need additional assistance complete the confidential Contact Form. Also, consider donating to continue this important work and expand our reach to the broader community. Contact Us: http://www.canmichigan.com/reach-out-to-us.html Donate: https://www.paypal.com/donate/?token=u9ZbQw7yTRWAm9K4Yl2MKERd76oKf_lBrejXuVLAx0j5rsSTG72gmICfR9S-bVY4az_Imm&country.x=US&locale.x=US Related Posts: Ban-the-Box Laws: Employment Rights for Felons http://www.canmichigan.com/blog/ban-the-box-laws-employment-rights-for-felons City of Detroit Project Clean Slate Free Expungement Fairs 2018 http://www.canmichigan.com/blog/city-of-detroit-project-clean-slate-free-expungement-fairs-2018 Returning Citizens http://www.canmichigan.com/returning-citizens.html

Category: Public Policy

Social welfare refers to the well-being of society and is designed to respond to social, economic, and political problems of constituents through the action or inaction of federal, state, or local governments by the creation of social welfare policy. of which social welfare programs are the result

While social welfare speaks to the collective well-being of society and the state of a healthy balance for people. Social welfare policy is the domain of maintaining society’s well-being and serves as the collective response to social problems. The social welfare system consists of the organized efforts and structures used to provide societal well-being. The government, however, does not have a program called “welfare.” But as a member of society, everyone is a part of the social welfare system where roles may vary depending on need, position, and at different points in life. Still, every person that exists in society participates in the social welfare, both, as a provider and a recipient.

The blatant inaction of the federal government not to intervene in a social problem or act on behalf of society typically is a sign that a decision has been made not to make it a national concern; and, to leave it up to local communities or social service agencies to deal with it. Social welfare programs are an outgrowth or product of social welfare policy. These programs are a response to the economic and social conditions of society. An example of this is the Social Security Act of 1935, the largest piece of welfare legislation until the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA) which regulates our current welfare system. The Great Depression was a time of such economic insecurity that something had to be done to correct the imbalance of the economy and provide some form of support for citizens. The Social Security Act was the government’s response. Changing Values and Beliefs in Social Welfare Policy Americans have a general value for supporting those in need such as giving to charity or just being socially caring but vary greatly in their view of these values. Such issues as determining the responsibility for other’s well-being and whether it is a personal or public matter? Collective or individual concern? Or, whether aid should be short or long-term? All these concerns serve as conflicting values when it comes to social welfare. Values are said to be the worth, desirability or usefulness placed on something. While beliefs can be summed up as an opinion or conviction. The thing to remember is that values are fluid. That is, they change over time and, certainly, with changing circumstances. For example, when a person is young and strong or financially stable they may firmly believe in personal responsibility. However, with age and changing life circumstances that leads to the reliance on the help of others, they will likely become more receptive to a collective approach to living and giving. Values and beliefs join forces when people have to decide whether they feel something is worth the investment of our resources such as time, money, or even public awareness. They also make it difficult to gather a consensus for national commitment to social problems. So, we examine the principles of values and beliefs which underpin social welfare services to help us understand the development, maintenance, and function of the social welfare system at any given point in time. Because change always comes with time. How Conflicting Views Complicate Social Welfare Policy Let’s discuss some of our conflicting views as it relates to the approach and provision of social welfare, how those beliefs and value systems shape social welfare policy, and how they affect the most needy and vulnerable in society. The majority of disagreements over the best choices in public policy derive from some very powerful, deep-seated belief systems. To this point, there are more broad areas of contention that have endured over time regarding social problems and how they should be addressed.

Examples of Need for Social Welfare: Deserving versus Undeserving Poor One of the biggest misconceptions I have heard is that only conservatives have a problem with welfare. But, with our shifting culture and greater emphasis placed on individuality in society – more and more liberals have now adopted the personal responsibility mantra. A demonstration of this was democratic President Bill Clinton’s Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA), what we know as the Welfare Reform Bill. This is where the welfare system forever changed with the introduction of work requirements for government benefits has its roots. So, when we look at the deserving versus the undeserving poor, although not new, the idea has resurfaced in modern liberal circles in what is known as Neo-Liberalism. Rest assured, there are neo-conservatives as well. However, in this view of deserving versus undeserving poor the idea is that poverty is acceptable within certain categories of poor people. Those categories typically include veterans, children, seniors, and disabled people that are accepted as “worthy of help.” That is, these people are in need through circumstances beyond their control. The other end of the spectrum is considered to be in control of their circumstances and they should be working hard, pulling themselves up by the bootstraps, and willing and grateful to accept any opportunity to work. The problem with this perspective is that there is little to no consideration for cause. The widow who lost all of their benefits due to the loss of a spouse or the unemployed worker whose company moved their job overseas are examples of legitimate cause. The assumption is that all able-bodied, working-age adults who encounter poverty does so as a personal failure rather than social structures that create barriers to resources. So, the political dilemma in writing social welfare policy is in determining whether the focus should be on the individual or society. Importance of Social Welfare Conflicts are inevitable in the social welfare system and interventions are needed, sometimes on a broad scale depending on the extent of the conflict, to minimize their impact. Social welfare policies and programs fulfills this need. We will not expound on all of the conflicting values that have been outlined. But I wanted to provide a brief examination of some of the issues faced in social welfare and provide an opportunity for us to consider the need and usefulness of federal aid. The goal is to understand the underlying values and beliefs that shape the social consciousness of contemporary society and how we may use that information to navigate the current state of the social welfare system. I want to encourage everyone to think clearly and objectively about how we feel on the issues that may not affect us today but what may be encountered in the future. But, not just to have an opinion…be informed. It is important to understand social welfare because it gives us the power to question, advocate for change, and make better decisions for our lives. Those who know the true strengths and weaknesses of social programs are better able to plan for the future. Was this post helpful? Leave a comment and please share with your followers. If you’re in need of case management services or need additional assistance complete the confidential Contact Form. Also, consider donating to continue this important work and expand our reach to the broader community. Related Posts: State Assistance Programs Enforce Work Requirements For Government Benefits http://www.canmichigan.com/blog/state-assistance-programs-enforce-work-requirements-for-government-benefits Redefining Social Welfare…Again http://www.canmichigan.com/blog/redefining-social-welfare-again |

Deborah MitchellWelcome to The Community Advocate Network. My name is Deborah Mitchell, I am a graduate in Social Work and Registered Social Work Technician. My human service background began in 2007 which includes medical case management and service navigation for the indigent population, outpatient mental health counseling with substance use and abuse disorders, supportive employment and job development for mental health consumers, and structured living domicile management. Archives

December 2023

Categories

All

|

RSS Feed

RSS Feed